Stuart Clark purchasing property and…. Warnies Pool!

John Gibson asks Stuart Clark “ Are cricketers getting the right advice away from the cricket field”

To listen to the full podcast click here.

- House prices have continued to rise across Australia’s five largest state capitals through the month of February.

- Pretty much all banks have done a complete back flip on their predictions from this time last year. Remember they were talking 30% drops in many sectors of the market.

- Auction clearance rates are there highest for years. Sydney hovering around high 80’s percent, Melbourne around 80 percent, Brisbane in the early 70’s percent. All other capitals performing very well.

- Population growth will play a big part in Australia’s property growth in the future. Australia’s population will probably grow to 30 million people in the coming decade (2030) and to circa 40 million people by 2048.

- I have touched on this previously – it’s important to note that households and small businesses are now paying back more than 80 per cent of almost $250billion in loans deferred at the height of the coronavirus pandemic.

- The reduction in our banks’ exposure to loans that may default puts them in a stronger position to continue lending and support of the economic recovery by lending to homeowners, investors and businesses.

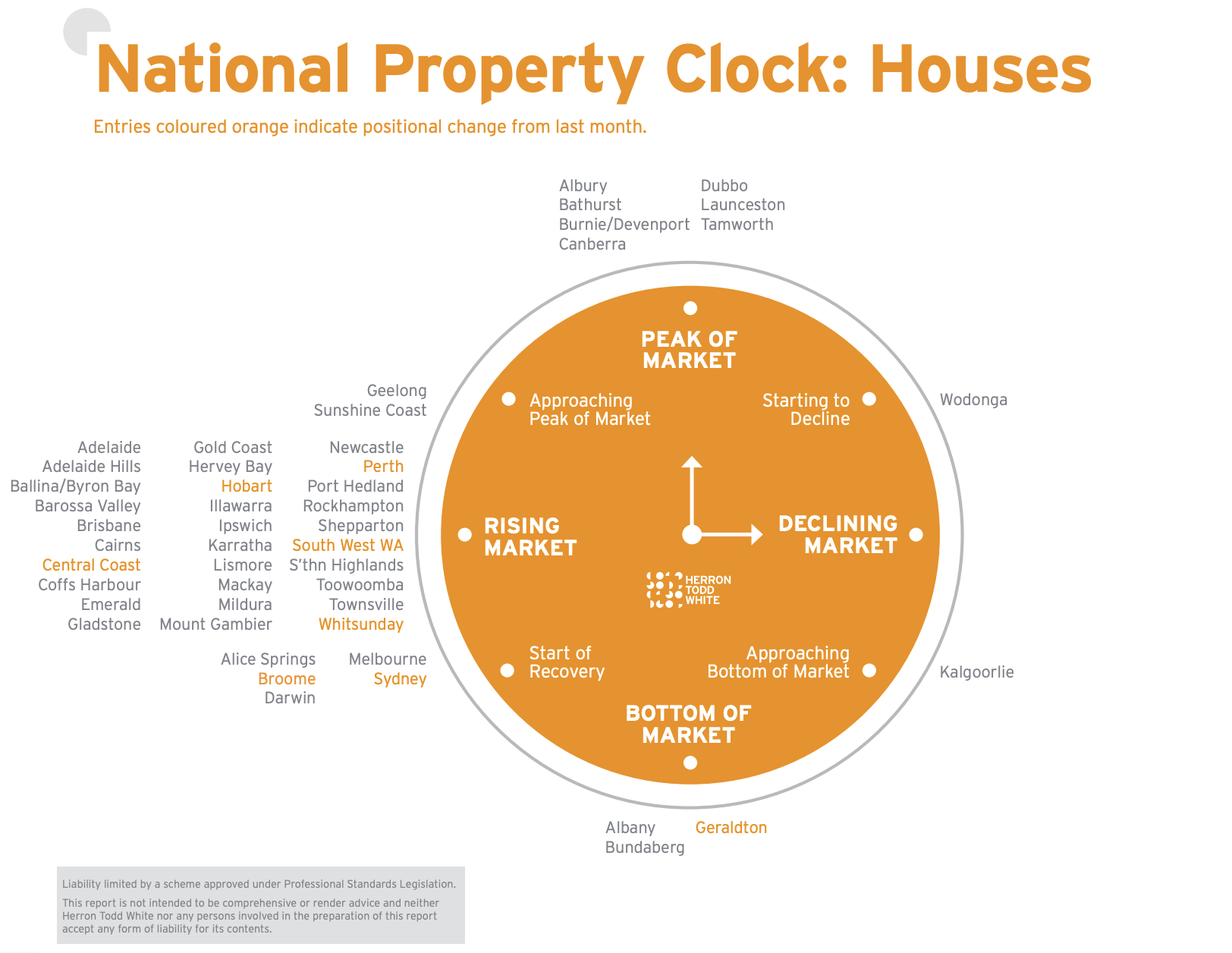

- Expect ongoing market strengthening across many regional centres.

- Interstate migration into QLD and Western Australia to potentially rise further. This will be positive for these markets.

- Double digit growth in the rural sector (farms) in many regions – on the back of bumper harvests and low interest rates – above normal rainfall in many areas, abundance of feed and record prices for stock. Central NSW, Tamworth, Mildura all performing very well.

- All markets look strong, however there are still challenging times for the office market, especially in CBD and fringe CBD locations.

Good news if you are looking to lease office space. Incentives are running high. Landlords want their spaces filled not empty!

Source: Herron Todd White

Tenant Representation Service

Legal practice secures new property to lease

Why: Require larger footprint

Buyer’s Agent Service – Commercial

National retail client secures Bulky Goods premises

Purpose: Retail showroom

Why: Secure trading future

Where: Keswick SA

Price: $4m

Buyer’s Agent Service – Residential

Client Purchase: House

Purpose: Owner occupied/ first home buyer

Why: Expanding family property purchase

Where: West Pennant Hills NSW

Price: $2070,000

Client Purchase: Apartment

Purpose: Investment

Why: Expanding property portfolio

Where: Inner West Sydney NSW

Price: $865,000

Sellers Advocacy- Residential

Client Sale: House

Purpose: Owner occupied property

Why: Downsizing

Where: Concord

Sold Price: $3,060,000

Click icon below

If you have a query or would like to know how we can assist you, please contact us today.