Property Report July 2019

Sydney residential market performance

Quick facts-

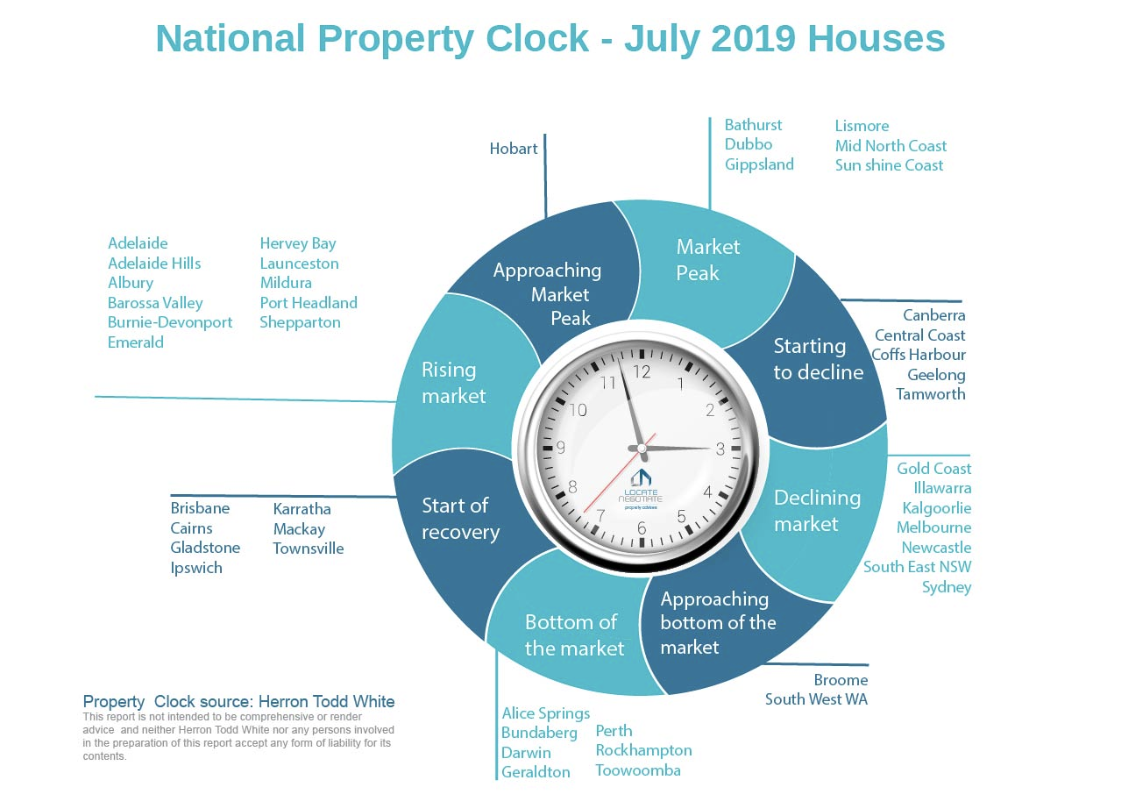

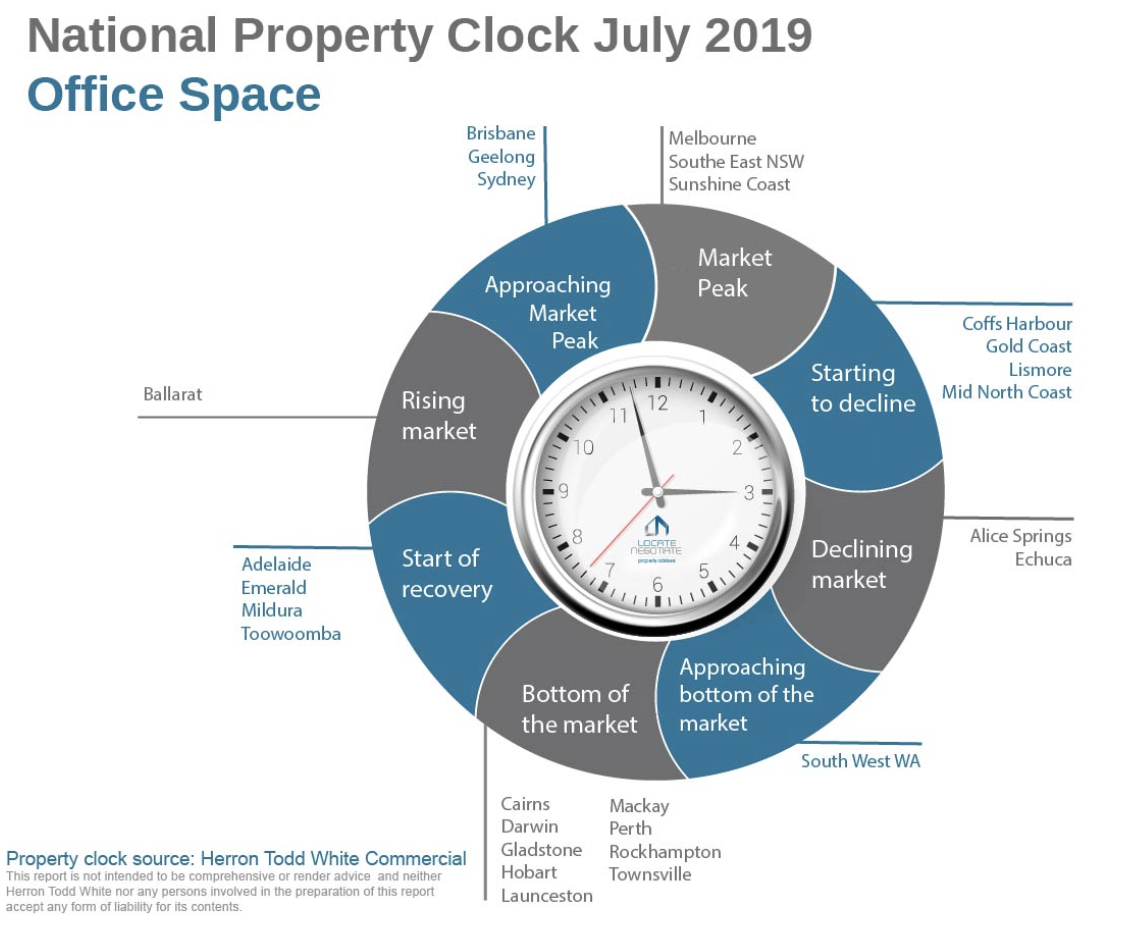

*Commercial real estate had mixed results across the country in the past six months, but among the options for buying in this sector, office holdings are considered one of the safer choices.

*Sydney, auction rates have improved on the back of vendor expectations meeting the market, the number of property transactions is down compared to 2018 and price declines have been slowing but are still down 4.3% from the start of the year to mid-May. There have been mixed results across Sydney with some areas performing better than others.

*Sydney CBD office vacancy tightening to 4.1% as of January, CBD office rentals have continued to drastically increase over the past two years and remain at record highs.

*Rural- The election is run and won, and it has rained in a few places – but more is generally needed. In addition, in large parts of NSW and Southern Queensland a lot of rain is still needed to see a real shift in forward. Therefore, buyer activity has settled down from the fervour of six to eight months ago.

*Sydney retail-The retail market in Sydney has been through a period of growth over the past twelve months. Demand has been increasing as has rental income. Vacancy rates have been generally lower.

Questions to ask yourself before renting commercial space

Need to upsize or downsize?

Are you getting the best deal?

Do you require an exit strategy from your existing premises?

Are you experienced enough to know the tenant traps and how to avoid them?

Consultancy

The owner of five small industrial buildings enlisted our services when occupancy dropped to 60%.

Brief

Provide an analysis of competing properties to determine competitive rents and market vacancy. Once we determined the market, we developed a strategy to overcome the problem.

We terminated the agreement with the current agent and appointed a highly experienced commercial agent, who thoroughly revamped the marketing of the property and adjusted the rent to a more competitive level.

Locate Negotiate worked closely with the agents and the owner to develop a marketing campaign that used cost-effective advertising techniques to drive traffic.

Outcome: Within six months, the portfolio stabilised at 100% occupancy.

Example of property advisory work undertaken for clients

Commercial property purchase (property buying services)

Location: Buderum QLD

Type: Commercial Property

Purpose: Investment

Details

Newly constructed, Tenanted, Occupancy Type- Childcare, Land Size-2643 Sqm, licensed for 90 kids

Net Income

$247,500 p.a. + GST, 15year net lease

Purchase Price: $4,110,000

Benefits to client: Growth

Location: Liverpool NSW

Type: Industrial Warehouse

Purpose: Established business looking for short term lease while building new facility

Details:

short term lease, size-5450 sqm, hard stand, container height access, close to M5,

Benefits to client: positioned close to existing address, limited disruption to current business, 18-month lease with option to extend if required, below market sqm rates negotiated

“A truly professional outfit! Locate Negotiate were instrumental in securing our commercial premises within the right time frame and budget. John invested a great deal of time understanding our needs. His knowledge and experience were a key factor in securing the right property for our business.”

Denise Smith