Episode 24 of Talking Real Estate, John is joined by Mark Coyne!

In this episode, Mark Coyne, celebrated former Dragons captain and seasoned business leader, discusses his unique role in guiding teammates through their property investments. John Gibson probes, asking if players were open about their financial situations and property buying decisions during Coyne’s playing days, especially as the Super League era brought significant financial changes.

Tune in for a conversation on leadership, financial openness, and investment in the dynamic realms of rugby league and business.

Check out the clip below…

To listen to the full podcast click here.

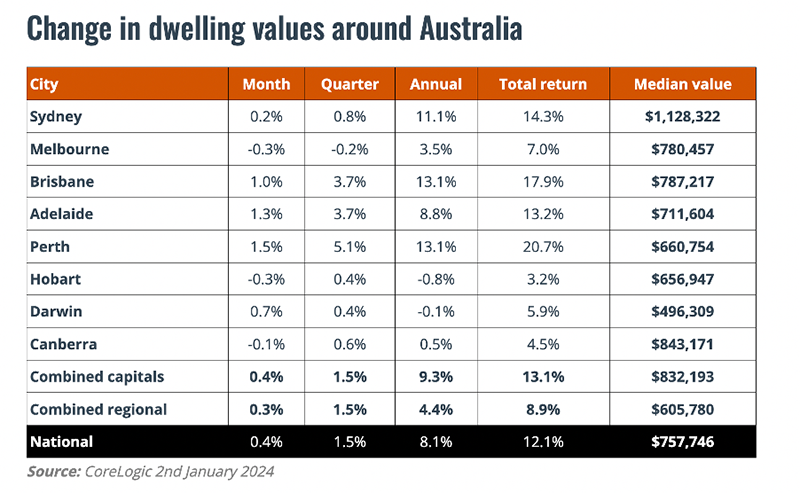

- Nationally, property stock levels have increased, though with variations across cities. Sydney experienced a modest 5% rise, while Melbourne saw about 10%, and Hobart surged by approximately 24%. However, Brisbane, Adelaide, and Perth still face constraints in their markets. Conversely, traditional blue-chip areas maintain low stock levels.

-

For developers, uncertainty looms large, regardless of size. Escalating building costs and high-interest rates have significantly squeezed profit margins, leaving little room for manoeuvre. The unforeseen cost surge triggered by inflation has only compounded these challenges.

- While other capital cities have witnessed property growth, Hobart stands out with a notable 15% price decrease in the last 12 months. No surprise, in my opinion. Investor lending is unmistakably on the upswing, constituting a growing portion of total lending. This resurgence in confidence is primarily attributed to stabilised interest rates.

-

A shift in demand is evident in commercial tenant office requirements, driven by changes in the workspace landscape. Flexible workspaces are gaining traction across all capital cities. Yet, uncertainty continues to loom over the office sector in Sydney, likely to persist throughout the year.

Buyer’s Agent Services

Purchased: Bonnet Bay (Sydney Metro)

Type: House

Private Treaty: Negotiation

Price: Not disclosed

Comments: Owner occupied purchase, slow but effective negotiation outcome for our

client.

Purchased: Bunderburg QLD

Type: House

Private treaty: Negotiation

Price: $477,400

Comments: Investment purchase, growth corridor, low vacancy rates, not flood

effected.

Commercial Tenant Representation

Type: Office

Successful: Lease renewal

Base Rent: $1,290 per sqm

Comments: Negotiated a rent deduction plus 33% incentive over 5-year term,

substantial savings for client.

Seller’s Advocacy Services

We’ve supported our clients in preparing their properties for the market. Both properties have undergone freshen up, and selling agents have been appointed. They are now actively listed on the market. We will provide guidance to our client and manage the agents during the selling process.

2A Short Street, Cronulla

6 McCullum’s Road, Berrilee

“Perfect is not attainable, but if we chase perfection, we can catch excellence.” – Vince Lombardi

Click icon below

If you have a query or would like to know how we can assist you, please contact us today.